Table of Contents

Right now, the gemstone world is under serious pressure. A ruby glowing from the mines of Myanmar, a velvety sapphire drawn from Madagascar’s soil, or a radiant emerald from Colombia’s emerald belt. These treasures pass through the expert hands of cutters, patient polishers, and visionary designers before being showcased. Yet in 2025, the sparkle now comes with a sharper price tag, thanks to sweeping U.S. tariffs.

At the dawn of the year, the U.S. introduced a flat 10% duty on most imports. For the gemstone and jewelry trade, however, the increases escalated quickly. By April, tariffs on cut and polished stones had already climbed into the 27-37.5% bracket, depending on the product classification. Then came the most dramatic move, in late August, imports of Indian gems and jewelry, the lifeblood of the global cutting and polishing industry, were hit with a 50% tariff, a staggering rise from the negligible 3% duties of previous years.

The tariff tsunami isn’t just an issue for India, it’s a global ripple effect. The gemstone trade is deeply interconnected: diamonds are mined in Africa and Russia and then are shipped to India for polishing, rubies originate in Myanmar and are often perfected in Thailand, sapphires hail from Sri Lanka, Madagascar, and Australia, while emeralds trace their roots to Colombia, Brazil, and Zambia. When a tariff messes up one part of the system, everyone feels it, from miners and manufacturers to wholesalers and retailers.

Buyers will notice these changes right away. Expect higher prices for natural tones as margins tighten. The breadth of designs is shrinking too, since many retailers are cutting back or limiting selection to manage costs. At the same time, alternatives such as lab-grown gems, semi-precious stones, and recycled jewelry are gaining traction. While these too carry tariffs, they are generally lower than those on natural diamonds and high-value gemstones. For example, lab-grown diamonds and synthetic stones now fall in the 27–34% range, semi-precious stones at about 27%, and imitation jewelry anywhere from 27% to 38%. Even pearls are taxed at around 27%. The rates are still significant, but for many buyers, these options provide a more affordable way to enjoy beauty without the steep costs tied to natural gems.

For an industry that once enjoyed low or zero import duties, India’s gems and jewelry sector is now facing one of its toughest trials. The U.S. absorbs about 30% of its exports, roughly $10 billion yearly, and the sudden jump to a 50% tariff has rattled the sector, with forecasts suggesting exports could plunge by as much as 70%. Smaller exporters had shipments before the deadline, whereas larger enterprises contemplated relocating to countries with lower tariffs, such as the UAE or Mexico. The Indian government is providing a ₹25,000 crore assistance package and urging exporters to explore diversification into alternative markets, although experts caution about possible job and profit losses.

Visited 1197 No. of Time(s), 300 Visit(s) Today

Abalone shell (121)

Abalone shell (121)

Actinolite (1)

Actinolite (1)

Affordable gemstones (17142)

Affordable gemstones (17142)

Afghanite (7)

Afghanite (7)

Agate (2496)

Agate (2496)

Agua nueva (11)

Agua nueva (11)

All gemstones (1)

All gemstones (1)

Amazonite (158)

Amazonite (158)

Amber (99)

Amber (99)

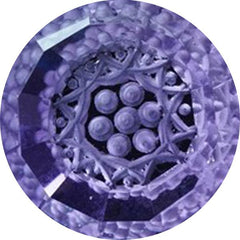

Amethyst (573)

Amethyst (573)

Ametrine (21)

Ametrine (21)

Ammolite (22)

Ammolite (22)

Ammonite (62)

Ammonite (62)

Andalusite (1)

Andalusite (1)

Andamooka opal (0)

Andamooka opal (0)

Andesine (0)

Andesine (0)

Angelite (28)

Angelite (28)

Apache gold (22)

Apache gold (22)

Apatite (139)

Apatite (139)

Apophyllite (1)

Apophyllite (1)

Apple valley agate (1)

Apple valley agate (1)

April birthstone (1835)

April birthstone (1835)

Aqeeq (0)

Aqeeq (0)

Aqua chalcedony (19)

Aqua chalcedony (19)

Aquamarine (72)

Aquamarine (72)

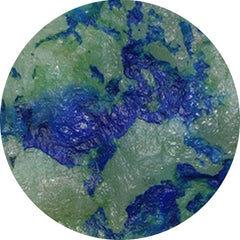

Aquaprase (60)

Aquaprase (60)

Aragonite (16)

Aragonite (16)

Arfvedsonite (12)

Arfvedsonite (12)

Aristolite (0)

Aristolite (0)

Arizona turquoise (0)

Arizona turquoise (0)

Arnioceras semicostatum fossil (0)

Arnioceras semicostatum fossil (0)

Asteroid jasper (12)

Asteroid jasper (12)

Astrophyllite (53)

Astrophyllite (53)

Atlantasite (87)

Atlantasite (87)

August birthstone (97)

August birthstone (97)

Aura quartz (0)

Aura quartz (0)

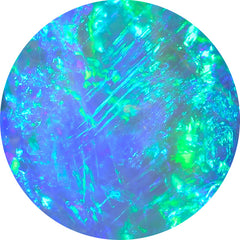

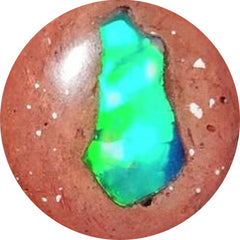

Aurora opal (297)

Aurora opal (297)

Australian opal (17)

Australian opal (17)

Aventurine (64)

Aventurine (64)

Azurite (284)

Azurite (284)

Azurite malachite (19)

Azurite malachite (19)

Banded agate (82)

Banded agate (82)

Barber agate (0)

Barber agate (0)

Barite (13)

Barite (13)

Beads (50)

Beads (50)

Beer quartz (23)

Beer quartz (23)

Berber agate (4)

Berber agate (4)

Best seller (0)

Best seller (0)

Bestsellers: a selection of our most-loved stones (401)

Bestsellers: a selection of our most-loved stones (401)

Biggs jasper (25)

Biggs jasper (25)

Bird carving (116)

Bird carving (116)

Bird eye jasper (47)

Bird eye jasper (47)

Birthstones (0)

Birthstones (0)

Biwa pearl (34)

Biwa pearl (34)

Black friday deals (33)

Black friday deals (33)

Black gemstones (949)

Black gemstones (949)

Black onyx (178)

Black onyx (178)

Black opal (49)

Black opal (49)

Black spinel (33)

Black spinel (33)

Black star (31)

Black star (31)

Black tourmaline (73)

Black tourmaline (73)

Blister pearl (30)

Blister pearl (30)

Bloodshot iolite (76)

Bloodshot iolite (76)

Bloodstone (68)

Bloodstone (68)

Blue chalcedony (51)

Blue chalcedony (51)

Blue diopside (0)

Blue diopside (0)

Blue horizon (15)

Blue horizon (15)

Blue kyanite (37)

Blue kyanite (37)

Blue lace agate (256)

Blue lace agate (256)

Blue mountain jasper (0)

Blue mountain jasper (0)

Blue opal (159)

Blue opal (159)

Blue quartz (40)

Blue quartz (40)

Blue topaz (51)

Blue topaz (51)

Bone (9)

Bone (9)

Botswana agate (245)

Botswana agate (245)

Bronze (0)

Bronze (0)

Bronzite (2)

Bronzite (2)

Bruneau jasper (15)

Bruneau jasper (15)

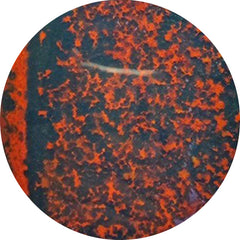

Bumble bee jasper (198)

Bumble bee jasper (198)

Buy gemstones in usa (879)

Buy gemstones in usa (879)

Cabochons (12878)

Cabochons (12878)

Cacoxenite (65)

Cacoxenite (65)

Calcite (219)

Calcite (219)

Calibrated (137)

Calibrated (137)

Calsilica (0)

Calsilica (0)

Candy corn (6)

Candy corn (6)

Cantera opal (17)

Cantera opal (17)

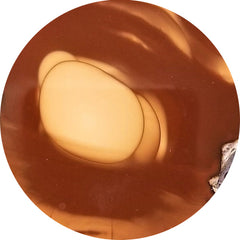

Caramel opal (2)

Caramel opal (2)

Carnelian (44)

Carnelian (44)

Carving (1761)

Carving (1761)

Carvings (2018)

Carvings (2018)

Cats eye (60)

Cats eye (60)

Cavansite (16)

Cavansite (16)

Celestobarite (7)

Celestobarite (7)

Ceruleite (0)

Ceruleite (0)

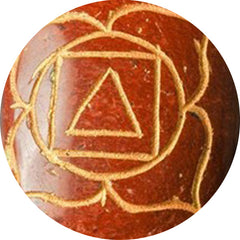

Chakra stone (31)

Chakra stone (31)

Chalcedony (457)

Chalcedony (457)

Charoite (190)

Charoite (190)

Cherry creek jasper (10)

Cherry creek jasper (10)

Chiastolite (16)

Chiastolite (16)

Chrome chalcedony (79)

Chrome chalcedony (79)

Chrome diopside (25)

Chrome diopside (25)

Chrysanthemum fossil (0)

Chrysanthemum fossil (0)

Chrysocolla (418)

Chrysocolla (418)

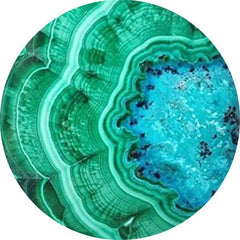

Chrysocolla malachite (74)

Chrysocolla malachite (74)

Chrysoprase (349)

Chrysoprase (349)

Cinnabar (15)

Cinnabar (15)

Citrine (106)

Citrine (106)

Cobalto calcite (66)

Cobalto calcite (66)

Cobra jasper (29)

Cobra jasper (29)

Coconut jasper (2)

Coconut jasper (2)

Coffee bean jasper (2)

Coffee bean jasper (2)

Conch shell (6)

Conch shell (6)

Coppernite (0)

Coppernite (0)

Coral (350)

Coral (350)

Covellite (4)

Covellite (4)

Crazy lace agate (189)

Crazy lace agate (189)

Crystal (201)

Crystal (201)

Cuprite (27)

Cuprite (27)

December birthstone (282)

December birthstone (282)

Dendritic agate (461)

Dendritic agate (461)

Dendritic opal (74)

Dendritic opal (74)

Dendritic quartz (2)

Dendritic quartz (2)

Desert glass (9)

Desert glass (9)

Desert jasper druzy (14)

Desert jasper druzy (14)

Desert sunset jasper (12)

Desert sunset jasper (12)

Dichroic glass (143)

Dichroic glass (143)

Dinosaur bone fossil (3)

Dinosaur bone fossil (3)

Diopside (59)

Diopside (59)

Doublets (855)

Doublets (855)

Dragonblood jasper (1)

Dragonblood jasper (1)

Druzy (438)

Druzy (438)

Dumortierite (60)

Dumortierite (60)

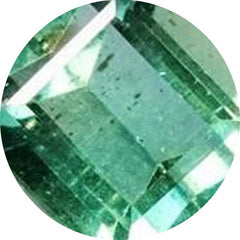

Emerald (63)

Emerald (63)

Epidote (10)

Epidote (10)

Ethiopian opal (175)

Ethiopian opal (175)

Eudialyte (11)

Eudialyte (11)

Faceted rose cut (2442)

Faceted rose cut (2442)

Fantasy cuts (50)

Fantasy cuts (50)

Fawn jasper (11)

Fawn jasper (11)

Feather agate (0)

Feather agate (0)

Feather pyrite (39)

Feather pyrite (39)

February birthstone (2864)

February birthstone (2864)

Fine amethyst (32)

Fine amethyst (32)

Fine ametrine (21)

Fine ametrine (21)

Fine andalusite (1)

Fine andalusite (1)

Fine apatite (5)

Fine apatite (5)

Fine aquamarine (8)

Fine aquamarine (8)

Fine black opal (6)

Fine black opal (6)

Fine black spinel (14)

Fine black spinel (14)

Fine blue topaz (30)

Fine blue topaz (30)

Fine chrysoprase (16)

Fine chrysoprase (16)

Fine citrine (23)

Fine citrine (23)

Fine emerald (9)

Fine emerald (9)

Fine ethiopian opal (17)

Fine ethiopian opal (17)

Fine fire opal (7)

Fine fire opal (7)

Fine fluorite (12)

Fine fluorite (12)

Fine garnet (32)

Fine garnet (32)

Fine iolite (31)

Fine iolite (31)

Fine kyanite (27)

Fine kyanite (27)

Fine lemon quartz (11)

Fine lemon quartz (11)

Fine lepidocrocite (45)

Fine lepidocrocite (45)

Fine moldavite (18)

Fine moldavite (18)

Fine moonstone (6)

Fine moonstone (6)

Fine peridot (55)

Fine peridot (55)

Fine prasiolite (26)

Fine prasiolite (26)

Fine ruby (15)

Fine ruby (15)

Fine rutilated quartz (19)

Fine rutilated quartz (19)

Fine sapphire (6)

Fine sapphire (6)

Fine sphene (17)

Fine sphene (17)

Fine sunstone (76)

Fine sunstone (76)

Fine tanzanite (50)

Fine tanzanite (50)

Fine tourmaline (67)

Fine tourmaline (67)

Fire agate (6)

Fire agate (6)

Fire opal (34)

Fire opal (34)

Flint stone (10)

Flint stone (10)

Fluorite (151)

Fluorite (151)

Fordite (62)

Fordite (62)

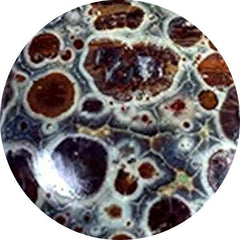

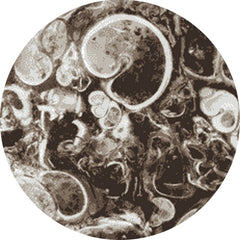

Fossil coral (318)

Fossil coral (318)

Fossil marston marble (19)

Fossil marston marble (19)

Fossils (504)

Fossils (504)

Freshwater pearl (22)

Freshwater pearl (22)

Fruit jasper (14)

Fruit jasper (14)

Fuchsite (7)

Fuchsite (7)

Fuschite (10)

Fuschite (10)

Galaxy jasper (9)

Galaxy jasper (9)

Garden quartz (6)

Garden quartz (6)

Garnet (117)

Garnet (117)

Garnet in limestone (36)

Garnet in limestone (36)

Gaspeite (12)

Gaspeite (12)

Gemstone lots (137)

Gemstone lots (137)

Geode (32)

Geode (32)

Ghost carving (55)

Ghost carving (55)

Gibeon meteorite (23)

Gibeon meteorite (23)

Gila monster agate (16)

Gila monster agate (16)

Gilson opal (22)

Gilson opal (22)

Glass (180)

Glass (180)

Glow stone (12)

Glow stone (12)

Goldstone (34)

Goldstone (34)

Grandidierite (7)

Grandidierite (7)

Grape agate (114)

Grape agate (114)

Grape chalcedony (4)

Grape chalcedony (4)

Green gemstones (456)

Green gemstones (456)

Green kyanite (7)

Green kyanite (7)

Green prase opal (8)

Green prase opal (8)

Green tourmaline (23)

Green tourmaline (23)

Grey moonstone (31)

Grey moonstone (31)

Guava quartz (6)

Guava quartz (6)

Hackmanite (11)

Hackmanite (11)

Heart carving (349)

Heart carving (349)

Heart shape gemstones (3)

Heart shape gemstones (3)

Heliodor (0)

Heliodor (0)

Hematite (37)

Hematite (37)

Hemimorphite (54)

Hemimorphite (54)

Herkimer diamond (38)

Herkimer diamond (38)

Himalayan quartz (433)

Himalayan quartz (433)

Honey quartz (19)

Honey quartz (19)

Howardite opal (28)

Howardite opal (28)

Howlite (5)

Howlite (5)

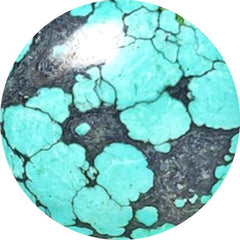

Hubei turquoise (47)

Hubei turquoise (47)

Hungarian agate (1)

Hungarian agate (1)

Hypersthene (42)

Hypersthene (42)

Ice quartz (1)

Ice quartz (1)

Idocrase (1)

Idocrase (1)

Imperial jasper (115)

Imperial jasper (115)

Imperial topaz (0)

Imperial topaz (0)

Indian paint stone (5)

Indian paint stone (5)

Iolite (168)

Iolite (168)

Iron quartz (48)

Iron quartz (48)

Jade (34)

Jade (34)

January birthstone (440)

January birthstone (440)

Jaspers (30)

Jaspers (30)

Jaspillite (3)

Jaspillite (3)

Java chalcedony (16)

Java chalcedony (16)

July birthstone (545)

July birthstone (545)

June birthstones: moonstone, pearl, and alexandrite (1046)

June birthstones: moonstone, pearl, and alexandrite (1046)

K2 jasper (7)

K2 jasper (7)

Kaleidoscope agate (0)

Kaleidoscope agate (0)

Kammererite (103)

Kammererite (103)

Kunzite (7)

Kunzite (7)

Kyanite (105)

Kyanite (105)

Labradorite (272)

Labradorite (272)

Laguna lace agate (62)

Laguna lace agate (62)

Lake superior agate (24)

Lake superior agate (24)

Landscape jasper (0)

Landscape jasper (0)

Langite (0)

Langite (0)

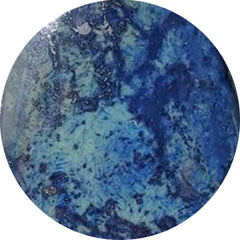

Lapis lazuli (159)

Lapis lazuli (159)

Larimar (115)

Larimar (115)

Larsonite (17)

Larsonite (17)

Larvikite feldspar (47)

Larvikite feldspar (47)

Lavender chalcedony (17)

Lavender chalcedony (17)

Lavender quartz (5)

Lavender quartz (5)

Lazulite (8)

Lazulite (8)

Lemon quartz (44)

Lemon quartz (44)

Leopard skin shell (0)

Leopard skin shell (0)

Lepidocrocite (54)

Lepidocrocite (54)

Lepidolite (79)

Lepidolite (79)

Lindy star sapphire (0)

Lindy star sapphire (0)

Lizardite (55)

Lizardite (55)

Lodolite (90)

Lodolite (90)

London blue topaz (10)

London blue topaz (10)

Malachite (575)

Malachite (575)

Maligano jasper (71)

Maligano jasper (71)

Marcasite (28)

Marcasite (28)

March birthstone (1472)

March birthstone (1472)

Marquise shape gemstones (5)

Marquise shape gemstones (5)

Mary ellen jasper (0)

Mary ellen jasper (0)

Maw sit sit (14)

Maw sit sit (14)

May birthstone (476)

May birthstone (476)

Meteorite (23)

Meteorite (23)

Mica (42)

Mica (42)

Midnight quartzite (20)

Midnight quartzite (20)

Millefiori glass (2)

Millefiori glass (2)

Mohave turquoise (55)

Mohave turquoise (55)

Mohawkites (20)

Mohawkites (20)

Moldavite (44)

Moldavite (44)

Monarch opal (27)

Monarch opal (27)

Montana agate (82)

Montana agate (82)

Mookaite (52)

Mookaite (52)

Moonstone (394)

Moonstone (394)

Morado opal (1)

Morado opal (1)

Morenci turquoise (40)

Morenci turquoise (40)

Morganite (0)

Morganite (0)

Moroccan seam agate (117)

Moroccan seam agate (117)

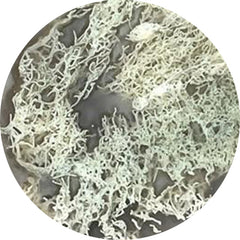

Moss agate (398)

Moss agate (398)

Mother of pearl (525)

Mother of pearl (525)

Mtorolite (46)

Mtorolite (46)

Mughal carving (453)

Mughal carving (453)

Muscovite (21)

Muscovite (21)

Mystic quartz (1)

Mystic quartz (1)

Native copper (39)

Native copper (39)

Natrolite (26)

Natrolite (26)

Nellite (5)

Nellite (5)

Nephrite jade (3)

Nephrite jade (3)

New arrivals (412)

New arrivals (412)

Noreena jasper (28)

Noreena jasper (28)

November birthstone (160)

November birthstone (160)

Nuummite (2)

Nuummite (2)

Obsidian (347)

Obsidian (347)

Ocean jasper (253)

Ocean jasper (253)

October birthstone (1331)

October birthstone (1331)

Olive quartz (5)

Olive quartz (5)

Onyx (286)

Onyx (286)

Opal (1109)

Opal (1109)

Opalina (11)

Opalina (11)

Opalite (29)

Opalite (29)

Opalwood (5)

Opalwood (5)

Orange gemstones (364)

Orange gemstones (364)

Orange kyanite (2)

Orange kyanite (2)

Oregon jasper (7)

Oregon jasper (7)

Orthoceras fossil (35)

Orthoceras fossil (35)

Outback jasper (5)

Outback jasper (5)

Oval shape gemstones (6)

Oval shape gemstones (6)

Over $50 (483)

Over $50 (483)

Pairs (936)

Pairs (936)

Palmroot agate (91)

Palmroot agate (91)

Passion agate (1)

Passion agate (1)

Peach moonstone (44)

Peach moonstone (44)

Peanut obsidian (40)

Peanut obsidian (40)

Peanut wood jasper (179)

Peanut wood jasper (179)

Pear shape gemstones (9)

Pear shape gemstones (9)

Pearl (652)

Pearl (652)

Peridot (64)

Peridot (64)

Petalite (25)

Petalite (25)

Petrified wood (53)

Petrified wood (53)

Phosphosiderite (93)

Phosphosiderite (93)

Picasso jasper (96)

Picasso jasper (96)

Picture jasper (96)

Picture jasper (96)

Pietersite (47)

Pietersite (47)

Pink gemstones (476)

Pink gemstones (476)

Pink opal (147)

Pink opal (147)

Pink tourmaline (89)

Pink tourmaline (89)

Pinolith (35)

Pinolith (35)

Plume agate (96)

Plume agate (96)

Polka dot agate (42)

Polka dot agate (42)

Polychrome jasper (43)

Polychrome jasper (43)

Porcelain jasper (30)

Porcelain jasper (30)

Prasiolite (54)

Prasiolite (54)

Prehnite (22)

Prehnite (22)

Psilomelane (23)

Psilomelane (23)

Purple chalcedony (44)

Purple chalcedony (44)

Purpurite (7)

Purpurite (7)

Pyrite (146)

Pyrite (146)

Quartz (131)

Quartz (131)

Rain moonstones (0)

Rain moonstones (0)

Rainbow calcilica (11)

Rainbow calcilica (11)

Rainbow moonstone (85)

Rainbow moonstone (85)

Red coral (8)

Red coral (8)

Red fossil (0)

Red fossil (0)

Red gemstones (358)

Red gemstones (358)

Red jasper (3)

Red jasper (3)

Red moss agate (77)

Red moss agate (77)

Red river jasper (17)

Red river jasper (17)

Rhodochrosite (404)

Rhodochrosite (404)

Rhodonite (91)

Rhodonite (91)

Rock chalcedony (2)

Rock chalcedony (2)

Rose cut gemstones (745)

Rose cut gemstones (745)

Rose quartz (53)

Rose quartz (53)

Rosita jasper (10)

Rosita jasper (10)

Round shape gemstones (6)

Round shape gemstones (6)

Ruby (197)

Ruby (197)

Ruby in fuchsite (6)

Ruby in fuchsite (6)

Ruby in zoisite (91)

Ruby in zoisite (91)

Rutilated quartz (260)

Rutilated quartz (260)

Sage brush jasper (27)

Sage brush jasper (27)

Sand dollar fossil (3)

Sand dollar fossil (3)

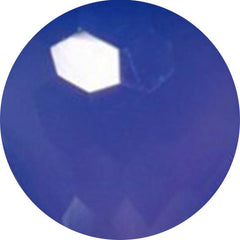

Sapphire (32)

Sapphire (32)

Saturn chalcedony (57)

Saturn chalcedony (57)

Scapolite (12)

Scapolite (12)

Scenic agate (96)

Scenic agate (96)

Schalenblende (89)

Schalenblende (89)

Scheelite (37)

Scheelite (37)

Scolecite (53)

Scolecite (53)

Sea sediment jasper (0)

Sea sediment jasper (0)

Selenite (13)

Selenite (13)

Septarian (91)

Septarian (91)

September birthstone (193)

September birthstone (193)

Seraphinite (80)

Seraphinite (80)

Serpentine (162)

Serpentine (162)

Sets (69)

Sets (69)

Shattuckite (277)

Shattuckite (277)

Shell (307)

Shell (307)

Shiva eye shell (60)

Shiva eye shell (60)

Shungite (4)

Shungite (4)

Sieber agate (0)

Sieber agate (0)

Silica (4)

Silica (4)

Silver leaf jasper (5)

Silver leaf jasper (5)

Sky blue topaz (5)

Sky blue topaz (5)

Smithsonite (29)

Smithsonite (29)

Smoky quartz (23)

Smoky quartz (23)

Snakeskin jasper (48)

Snakeskin jasper (48)

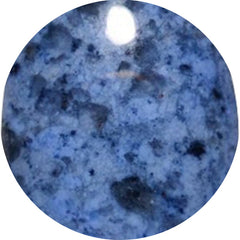

Sodalite (70)

Sodalite (70)

Solar agate (3)

Solar agate (3)

Solar quartz (62)

Solar quartz (62)

Spectrolite (118)

Spectrolite (118)

Sphence (25)

Sphence (25)

Spiderweb jasper (1)

Spiderweb jasper (1)

Spiderwoman jasper (0)

Spiderwoman jasper (0)

Spiny oyster shell (66)

Spiny oyster shell (66)

Spurrite (7)

Spurrite (7)

Square shape gemstones (10)

Square shape gemstones (10)

Starburst (2)

Starburst (2)

Sterling opal (10)

Sterling opal (10)

Stichtite (37)

Stichtite (37)

Stick agate (5)

Stick agate (5)

Stitchtite (123)

Stitchtite (123)

Stramatolite (0)

Stramatolite (0)

Strawberry quartz (7)

Strawberry quartz (7)

Sugilite (0)

Sugilite (0)

Sunstone (265)

Sunstone (265)

Surfite (2)

Surfite (2)

Swiss blue topaz (32)

Swiss blue topaz (32)

Swiss opal (3)

Swiss opal (3)

Tanzanite (51)

Tanzanite (51)

Tanzurine (11)

Tanzurine (11)

Teal kyanite (9)

Teal kyanite (9)

Tektite (42)

Tektite (42)

Thomsonite (35)

Thomsonite (35)

Thulite (79)

Thulite (79)

Thunder egg agate (0)

Thunder egg agate (0)

Tiffany stone (6)

Tiffany stone (6)

Tiger eye (66)

Tiger eye (66)

Titanium druzy (5)

Titanium druzy (5)

Topaz (55)

Topaz (55)

Tourmaline (234)

Tourmaline (234)

Tourmaline in quartz (84)

Tourmaline in quartz (84)

Treated opal (51)

Treated opal (51)

Tree agate (41)

Tree agate (41)

Trilobite fossil (17)

Trilobite fossil (17)

Trolleite quartz (28)

Trolleite quartz (28)

Tumbles (1)

Tumbles (1)

Turkish tube agate (64)

Turkish tube agate (64)

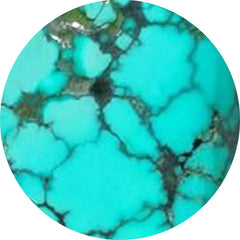

Turquoise (231)

Turquoise (231)

Turritella jasper (3)

Turritella jasper (3)

Tuxedo agate (64)

Tuxedo agate (64)

Unakite (3)

Unakite (3)

Uvarovite garnet (3)

Uvarovite garnet (3)

Valentine (806)

Valentine (806)

Vanadinite druzy (9)

Vanadinite druzy (9)

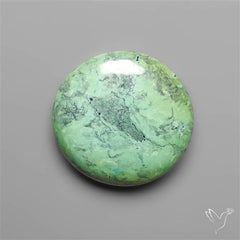

Variscite (159)

Variscite (159)

Vesuvianite (1)

Vesuvianite (1)

Video collection (243)

Video collection (243)

Vivianite (1)

Vivianite (1)

Volcanic cotham marble (7)

Volcanic cotham marble (7)

Wagul jasper (3)

Wagul jasper (3)

White buffalo turquoise (13)

White buffalo turquoise (13)

White gemstones (1202)

White gemstones (1202)

White horse canyon (45)

White horse canyon (45)

White moonstone (35)

White moonstone (35)

White opal (12)

White opal (12)

Wild horse jasper (119)

Wild horse jasper (119)

Wild horse magnesite (49)

Wild horse magnesite (49)

Wonder stone (0)

Wonder stone (0)

Wood (207)

Wood (207)

Yavapai travertine (0)

Yavapai travertine (0)

Yellow gemstones (168)

Yellow gemstones (168)

Yellow opal (7)

Yellow opal (7)

Yellow sapphire (6)

Yellow sapphire (6)

Yemeni aqeeq (0)

Yemeni aqeeq (0)

Zarinite (0)

Zarinite (0)

Zebra jasper (1)

Zebra jasper (1)

Zultanite (4)

Zultanite (4)

Leave a Comment