Table of Contents

Gemstones are becoming increasingly important for investors looking to diversify their portfolio. Unlike stocks, which always have the possibility of volatility, or cryptocurrencies, which are based on pure speculation, gemstones like rubies, Paraiba tourmalines, and amethysts possess intrinsic and emotional value. It is their unique aesthetic, scarcity, and longevity that make these stones a natural resource. The ideal gemstones cannot be replicated or exchanged for money because their worth is acknowledged on every continent around the world.

There is great optimism for the gemstone business in 2025. Demand is high in the luxury space, supply is diminishing as mines on the planet are largely depleted, and prices are reaching record levels at auction houses. Gemstones are not only a unique item to own, but they also allow for unique investment opportunities.

Gemstones As Assets

Investing in gemstones doesn’t have to be only about aesthetics, it also means investing in wealth through tangible assets. Historically, gemstones have been closely associated with royalty, tradition, and fashion. However, gemstones are beginning to be seen as a trusted store of value in the latest portfolios. The ability of gemstones to hold and appreciate worth is due to some timeless qualities surrounding them and, in large part, to their scarcity, cultural appeal, and global recognition.

In this blog, we will discuss the best gemstones for investment in 2025, explore the use of semi-precious stones for investing, understand the factors influencing the value of gemstones, and also share useful tips for buying, holding, and selling. Whether you are curious about gemstone investment for beginners or trying to grow your portfolio, this guide covers everything that you need to know.

Why Consider Investing in Gemstones This Year?

If you are wondering, “Are gems a good investment in 2025?” Here are some reasons why the answer is yes!

- Scarcity is on the rise:

Mines that used to supply the world with great stones are drying up. For example, tanzanite is only found in a specific region in Tanzania, and Paraiba tourmalines are found in extremely limited amounts. With less of something available, the value increases.

- Growing demand around the globe:

Emerging markets in Asia and the Middle East have a growing appetite for rare gemstones. Additionally, luxury brands are helping to drive demand, which is also beneficial to the colored gems market, as they are expanding through the high jewelry collections of colored stones.

- Varieties of Portfolio:

Gemstones do not follow the market trends, they can be effective hedges against volatility. Adding them to your portfolio will allow you to spread the risk and provide an indefinite, tangible asset.

- Long-term stability:

When it comes to rubies, sapphires, and emeralds that have a high quality, these types of stones have held and risen in value over a long period of time, and have brought patient investors a secure return.

- Emotional & cultural value:

Beyond their financial worth, gemstones provide beauty, symbolism, and emotional value. They are timeless possessions and can be passed down to generations.

Best Gemstones for Investment

When building an investment portfolio of gems, not all stones are created equal. There have been gemstones that have been good to excellent performers in value retention and appreciation, as well as some attractive stones that are currently climbing the space of demand and rarity. That will be the focus of investors in 2025, gemstones that possess beauty, rarity, and marketability to fill their collection. From legendary rubies and emeralds to vibrant semi-precious stones, the right gemstones have great aesthetic potential as well as real investment potential.

Here’s a top list of the best investment gems:

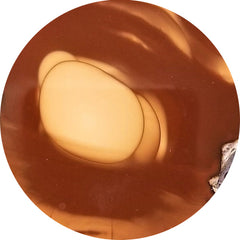

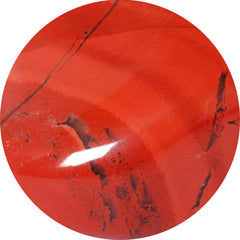

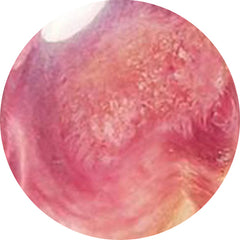

- Ruby: The “King of Gemstones,” rubies are prized for their incredibly rich, deep color and their exceptional rarity. Specific to any untreated ruby from either Burma or Mozambique is even more desirable and collectible.

- Emeralds: Vivid green with minimal treatments, Colombian emeralds are still among the most sought-after investment gemstones. The combination of rarity with luxury continues to enhance their durability.

- Blue Sapphire: Because of their spectacular beauty and durability, Kashmir, Ceylon, and Burmese sapphires are admired by both collectors and jewelry lovers. The timeless beauty of this gemstone creates stability for collectors’ demand.

- Pink Diamonds: Natural diamonds have always been extremely rare and collectible, they are valuable and continue to achieve groundbreaking prices at various auctions.

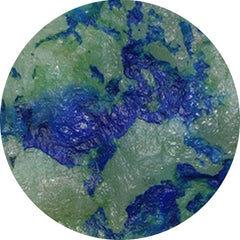

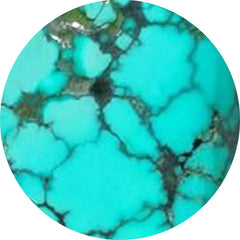

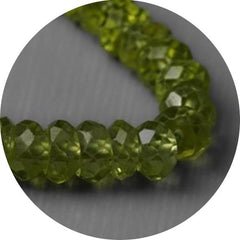

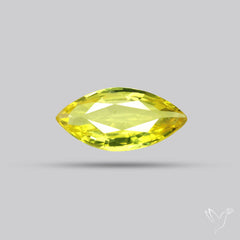

- Paraiba Tourmaline: Paraiba has a striking neon blue-green color that makes it eye-catching, and it is found in limited supply, which adds to its uniqueness and value.

- Spinel: Once neglected, spinel has seen a resurgence in popularity due to its attractive colors, such as red and cobalt blue, and its rarity as a limited-source investment stone.

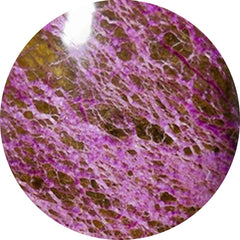

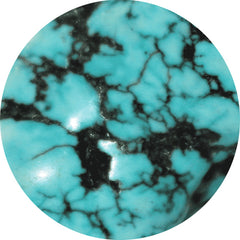

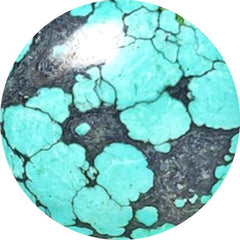

- Tanzanite: Found only in Tanzania, tanzanite has earned respect for its blue-violet colors and scarcity, making it a great stone for both collectors and investors alike.

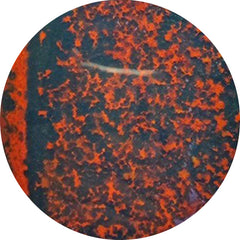

- Alexandrite: Valued for its rarity and exceptional color fidelity, the shift from green to red makes it a coveted gemstone.

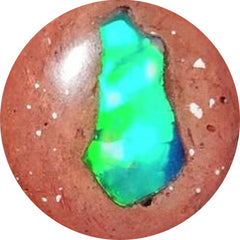

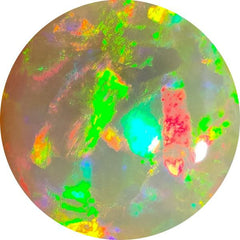

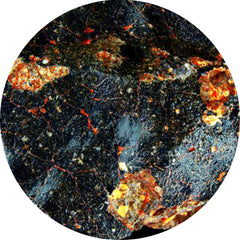

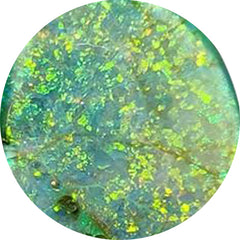

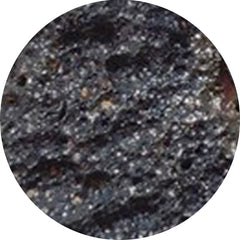

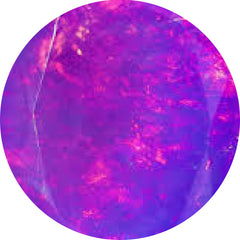

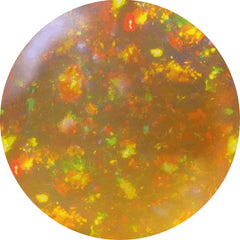

- Black Opal: Sprightly play-of-color Australian black opal is an extremely rare and collectible gemstone, and many examples are collected for the highest of prices.

- Imperial Topaz: Appreciated for its beautiful golden-pink hues, imperial topaz is a rare and beautiful gemstone that demands high prices.

- Tourmaline (rare colors): Besides Paraíba, rare colors of tourmaline, like watermelon, bicolor, etc., are starting to attract investment interest.

These gemstones truly represent a remarkable combination of rarity, beauty, and desire in the marketplace for 2025. These are stones that collectors will appreciate but also provide a legitimate investment opportunity that dovetails aesthetic enjoyment and financial worth over time.

|

Stones |

Origin |

Price |

|

Ruby |

Myanmar, Thailand, Mozambique |

$1,000 - $100,000+ |

|

Emerald |

Colombia, Zambia, Brazil |

$500 - $50,000+ |

|

Blue Sapphire |

Kashmir, Sri Lanka, Myanmar |

$800 - $75,000+ |

|

Pink Diamond |

Australia, South Africa |

$10,000 - $1,000,000+ |

|

Paraiba Tourmaline |

Brazil, Mozambique, Nigeria |

$5,000 - $50,000+ |

|

Spinel |

Myanmar, Sri Lanka, Vietnam, Tanzania |

$200 - $10,000+ |

|

Tanzanite |

Tanzania |

$200 - $2,000+ |

|

Alexandrite |

Russia, Brazil, Sri Lanka |

$1,000 - $30,000+ |

|

Black Opal |

Australia |

$1,000 - $20,000+ |

|

Imperial Topaz |

Brazil |

$500 - $5,000+ |

Looking to diversify your gemstone investments? Discover the most valuable red stones in List of Top Red Gemstones - Every Jewelry Designer Should Know Before Buying.

Semi-Precious Stones for Investment:

Gemstone investments don't always have to break the bank. Semi-precious stones for investment are perfect for entry-level investors or for those who would like to diversify their collection without shelling out too much cash. While semi-precious gems will *not* get the same headlines as rubies or emeralds, they provide solid demand, aesthetics, and ongoing appreciation.

Some of the most promising semi-precious stones in 2025 include:

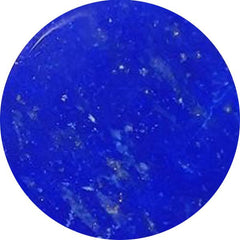

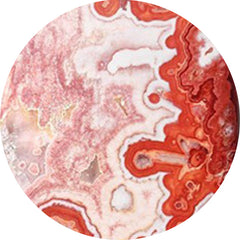

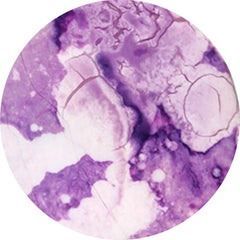

- Amethyst: Once an exceedingly rare stone, amethyst is still a widely recognized, popular, and inexpensive choice for investment. Deep, rich purple stones with clarity are most desired.

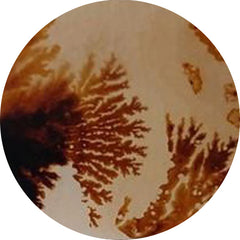

- Garnet: Garnet is not just red bricks; people are becoming increasingly enamored with tsavorite or demantoid garnets. The value of these unique colored gems, their durability, and the admiration they inspire provide solid investment potential.

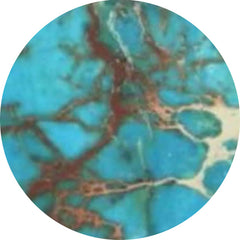

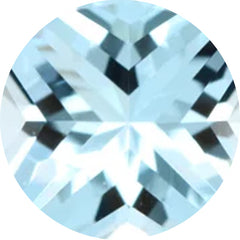

- Aquamarine: This gentle blue gem is not only beautiful but also very mainstream due to its high clarity. A single aquamarine stone in sizes greater than 12 ct can easily command a strong dollar value.

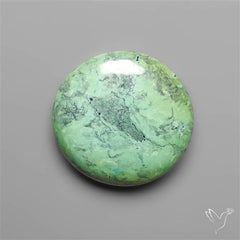

- Moonstone: Among modern and recent investments, moonstone is soon to be on an escalated appreciation due to its glowing appearance and appeal in designer jewelry, and is a semi-precious gem that, with more designed recognition and potential value, can possibly become a long-term investment.

Semi-precious stones offer a way in for beginners and allow them to gain experience and possibly develop their portfolios and wealth. These are stones that have aesthetic value and opportunity costs associated with their beauty, and are generally in the perfect sector for a balanced investment approach.

Factors that Influence the Value of Gemstones

A gemstone's value is determined by several related attributes that collectors and investors need to consider:

- Rarity: Rarity drives value. Gems such as Paraíba tourmaline, alexandrite, and Burmese rubies are some of the rarest, which gives them their value.

- Origin: The location of origin of the gemstone affects the value. For example, Colombian emeralds and Kashmir sapphires are more valuable than comparable diamonds from lesser-known origins.

- Color: Put simply, the stronger and brighter the color and the more evenly spread across the stone, the more it is worth.

- Clarity: Typically, diamonds that have high clarity, i.e., they have no visible inclusions or blemishes, are worth more. Certain stones, like emeralds and certain sapphires, may always have some inclusions, in which case the value would depend on the type of inclusion and where it is located.

- Cut: A well-executed cut is going to show brilliant sparkle, highlight color, and present the stone as most visually pleasing. A good cut increases the value of a gemstone considerably.

- Weight in carats: Larger gems are rare, and as size increases, the price per carat often increases exponentially.

- Treatments and enhancements: Untreated stones will always be worth more than treated stones and may also change the appearance and the investment value, such as heated or oiled stones.

- Certification: A good gemological report from a reputable lab, such as GIA or IGI, certifies authenticity and clarity/color grade and adds credibility to the buyer.

- Market Demand: Recognizing these different points of consensus (popularity, collectors, and cultural references) can influence price substantially.

Recognizing these factors can help investors when considering their own purchase of stones that are visually interesting and that can maintain value in the realm of commodity exchange.

Before making any gemstone investment, understand the difference between lab-grown and natural gems in Lab-Grown vs Natural Gemstones: What Every Jewelry Maker & Buyer Should Know.

Tips for Investing in Gemstones

Investing in gemstones requires careful research, strategy, and patience. Here are some key considerations:

- Buy Certification: Always purchase gemstones that have been certified by a reputable laboratory for authenticity, quality, and origin.

- Choose Untreated Gems: In general, natural and untreated gems tend to hold value better over time than treated gems.

- Start Small: Simply put, if you are not an experienced gemstone collector, begin your experience and education of the gemstone market with a semi-precious gem or small stones until you learn more about the investment value of fine gems.

- Diversify Your Collection: One way to reduce risk is to spread your investments across all different types of gems in a collection.

- Work with Trusted Professionals: Trusted dealers, auction houses, and gemologists will assist in determining authenticity when you are investing in fine gemstones.

- Store and Insure: It is also important to store and insure your gems properly, that is, to protect your investment against theft, damage, or loss.

- Play a Long Game: In most cases, gemstone investments should be planned on a holding period of 5-15 years to realize meaningful appreciation.

If you follow all the described guidelines, a smart investor can minimize risks and maximize returns and, of course, enjoy the beauty of the collection.

Risks to be Aware of

While gemstones can be profitable, there are some risks every investor needs to be aware of:

- Liquidity issues: Unlike stocks or gold, gemstones can experience longer selling times, especially for rare or high-value stones.

- Market volatility: Fashion trends and collector interest can influence the demand and pricing of specific gems.

- Counterfeits and mischaracterization: Some gems, particularly synthetic, treated, or imitation stones, may be sold as natural, resulting in financial loss.

- Complicated valuation: The prices of most commodities can be referenced on public boards, while the value of gemstones requires a professional evaluator to determine the actual market value.

- Cost of storage and insurance: Protecting your gemstones will incur costs and ultimately reduce your overall net return to you as the investor.

- Higher capital required for gift gems: High-carat rubies, sapphires, and/or diamonds may require greater capital than some investors can fund.

The knowledge of these risks, for you, the investor, creates an informed investor with options to refrain from commodity pitfalls in gemstones.

If you’re buying gemstones for profit, The Jewelry Maker’s Gemstone Buying Guide: How to Choose, Compare, and Source for Profit is a must-read companion to this article.

Final Thoughts

Gemstones are not just jewelry but actual, tangible assets that blend beauty with investment. In many markets in 2025, there are opportunities for purchase from the “Big Three” (rubies, sapphires, and emeralds) to lesser-known investment stars such as Paraíba tourmaline, spinel, and other semi-precious stones.

Gem investment requires some understanding and might require thoughtful discretion, certification, and holding time. Whether you choose a rare ruby, an engaging aquamarine, or a semi-precious stone on the rise, the stones are always a mix of financial stability, beauty, and cultural meaning. Thinking strategically about your investment in gemstones can facilitate the growth of a portfolio that is as engaging as it is valuable — with stunning pieces you can explore on GemstonesForSale, stones that can be seen and enjoyed, and perhaps passed on for future generations.

FAQ

1. Are gemstones a good investment in 2025?

Yes, if they are natural, untreated, and certified stones. They have inherent rarity and value appreciation over time.

2. What gemstones are best for investments?

The best stones for investments include rubies, emeralds, sapphires, pink diamonds, and Paraíba tourmalines.

3. Can semi-precious stones provide value returns?

Absolutely. Semi-precious stones, such as garnet, aquamarine, and moonstone, are affordable, accessible, quite popular, and great for budding collectors.

4. How do I determine the selling price of the gemstone?

The value of a gemstone is determined by its rarity, origin, color, clarity, cut, carat weight, treatments, certifications, and the marketplace.

5. What would the length of time a gemstone needs to be held before selling be?

Experts say 5 to 15 years is a recommended length of time to hold gemstones, while many gemstones generate the best returns over decades.

Visited 798 No. of Time(s), 67 Visit(s) Today

Leave a Comment